NexJ Systems Inc

Web, Desktop and Tablet Design

As the only Product Designer that worked at NexJ I lead the design initiative designing new products, maintaining, updating and re-designing the user interfaces and user experiences. I worked with multiple teams designing for the Data Bridge team, Reporting team, Nudge Team and CRM Team. Additionally, user research and user interviews were conducted with assistants and financial advisors from RBC for new products, this was a combined effort by the team from myself, to the Product Manager and VP of Product Management. The FinTech SaaS products were developed for wealth management, private banking, commercial banking and corporate banking clients to improve client engagement and unlock new revenue opportunities while reducing the burden of cost and compliance.

The product development process was maintained with a team comprising of a UX Writer, Program Managers, Developers and VP of Product Management, Stakeholders and Head of Design. I lead design sessions with the team to explain design rational to a technical or non technical audience, created different user personas and user journeys. Also, user interface bug fixes were addressed live on Figma with the QA team.

A design system was also developed to maintain consistency across the board, the products is designed for different platforms, desktop, web and tablet dimensions.

Nudge is designed to drive engagement and compliance by augmenting advisor intelligence, to equip advisors with real-time data driven recommendations around the best actions they can complete to serve clients in a more relevant and contextual manner.

Client feedback on

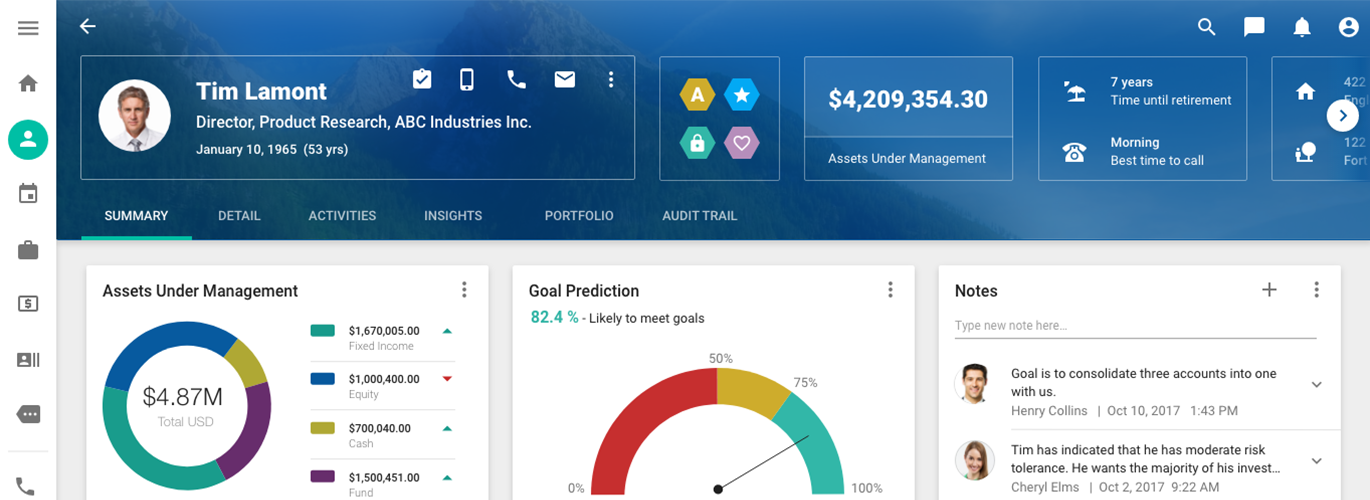

The Advisor Desktop

A case study by one of our clients Wells Fargo on the benefits of the platform.

CRM and Household integration to existing workflow

Result shows increased productivity and efficiency from advisors.

The household feature allows advisors to model complex relationships including referrals, family relationships, related parties, companies, and advisor-defined groups. Providing added flexibility, supporting both hierarchical and ad hoc groupings such as associations or professional affiliations.

Household is designed to assign an unlimited number of parent-child and arbitrary relationships for a contact, such as those between spouses, joint account owners, a customer and accountant, and more. The ability to support modeling one-to-one, one-to-many, many-to-many, and many-to-one relationships throughout the system.

The platform comprises of financial services-specific CRM, Client Engagement Tools, and Integrated Desktops designed to increase user productivity, optimize customer value, improve customer loyalty, deliver personalization, grow assets under management, maximize share of wallet, and drive customer success. The product uses artificial intelligence, machine learning, and analytics.

Leads also provides a deep vertical products support to streamline business processes, drive efficiency and boost adoption rates. The goal is to streamline lead and referral management processes in order to drive best practices for capturing, scoring, distributing, and nurturing these opportunities to drive conversions and maximize profitability.

News and Research Recommendations is designed to provide advisors with opportunities for interactions throughout the buying journey, to leverage demographic and account information via data aggregation capabilities. NexJ uses a sophisticated AI engine to match client interests to news from either wealth management-specific premium news feeds, 15,000 publicly available news streams, or a firm’s own research. Content is presented in client-specific dashboard. Advisors can browse content and send articles to clients with the click of a button.

Case Study: NexJ Systems Inc

Project Overview

Project: NexJ Systems Inc - FinTech SaaS Product Suite

Objective: Lead the design initiative to create, maintain, and update user interfaces and experiences for various teams, including Data Bridge, Reporting, Nudge, and CRM.

Role: Lead Product Designer

Tools: Figma, Miro, Adobe Photoshop

Project Dynamic: Team project

Project Type: Web, Desktop and Tablet Application

Deliverables: High-fidelity mockups, wireframes, user personas, user journeys, and a comprehensive design system for desktop, web, and tablet platforms.

Problem Statement

NexJ Systems Inc needed a robust suite of FinTech SaaS products for wealth management, private banking, commercial banking, and corporate banking clients. The goal was to improve client engagement, unlock new revenue opportunities, and reduce costs and compliance burdens.

Research and Discovery

User Needs:

Enhanced client engagement tools for financial advisors.

Real-time data-driven recommendations to augment advisor intelligence.

Streamlined business processes to drive efficiency and adoption rates.

Secure, compliant communication channels for clients and advisors.

User Research:

Conducted user interviews with assistants and financial advisors from RBC.

Collaborated with the Product Manager, VP of Product Management, and other stakeholders to gather insights and feedback.

Key Insights

Advisors need real-time, actionable insights to serve clients more effectively.

Efficient lead and referral management processes are critical for maximizing profitability.

Secure communication and comprehensive client data are essential for compliance and personalized service.

Design Process

1. Ideation and Conceptualization:

Brainstormed with the team to develop initial design concepts.

Created user personas and journey maps to visualize user interactions and identify key touchpoints.

2. Low-fidelity Prototyping:

Developed wireframes to outline the structure and functionality of the dashboards and reports.

Ensured the design provided an intuitive and user-friendly experience for advisors and clients.

3. High-fidelity Prototyping:

Designed high-fidelity mockups for desktop, web, and tablet dimensions.

Key Features:

Advisor Workspace: Real-time data visualization of clients data in a report view.

Reports: Overview of clients metrics.

Analytics Graphs: Detailed graphs showing financial analytics and trends.

4. Design System:

Developed a comprehensive design system to maintain consistency across all platforms.

Standardized design elements, color schemes, and typography.

5. Iteration and Testing:

Conducted usability testing with target users to gather feedback and identify areas for improvement.

Iterated on the designs based on user feedback to enhance the overall user experience.

Key Features

Nudge: Provides real-time, data-driven recommendations to advisors to enhance client engagement and compliance.

Advisor Desktop: Increases productivity and efficiency for financial advisors through CRM and household integration.

Household Feature: Allows modeling of complex relationships, supporting both hierarchical and ad hoc groupings.

Leads: Streamlines lead and referral management processes to maximize conversions and profitability.

News and Research Recommendations: Leverages AI to match client interests with relevant news and research, presented in a client-specific dashboard.

Results and Impact

Improved Efficiency: Streamlined business processes and enhanced advisor productivity.

Enhanced User Experience: Positive feedback from users on the intuitive and user-friendly interface.

Consistency Across Platforms: The design system ensured a seamless and consistent experience across desktop, web, and tablet devices.

Increased Client Engagement: Real-time insights and personalized recommendations led to better client interactions and satisfaction.

Reflections and Learnings

The importance of comprehensive user research to understand user needs and pain points.

The value of iterative design and testing to refine the user experience.

The impact of a well-designed FinTech product suite on improving efficiency, engagement, and profitability.

Conclusion

The NexJ Systems Inc FinTech SaaS product suite successfully addressed the challenges faced by financial advisors and clients. By focusing on user needs and providing a consistent, user-friendly interface, the system improved efficiency, engagement, and compliance, ultimately driving better client outcomes and business success.

Notes and Sketches

Design Discovery Phase

Inform and Engage - News and Research Recommendations

CRM, Client Engagement Tools and Leads

Network Relationship Graph - Household

Nudge